The Importance of Adaptability During Financial Crises: A Comprehensive Guide

Introduction to Financial Crises: Historical Context

Financial crises are periods of severe disruption in financial markets, characterized by sharp declines in asset prices and the failure of key financial institutions. These crises have profound economic consequences, affecting businesses, governments, and individuals. Historically, financial crises have been a recurring phenomenon, with notable examples including the Great Depression of the 1930s, the Asian Financial Crisis of 1997, and the Global Financial Crisis of 2008. Each of these events provides valuable lessons on the importance of adaptability in navigating financial turbulence.

During the Great Depression, for instance, the stock market crash of 1929 led to widespread bank failures and a collapse in consumer confidence. The economic impact was devastating, resulting in massive unemployment and poverty. However, it also prompted significant changes in financial regulations and government intervention, emphasizing the need for adaptability in policy making.

The Asian Financial Crisis of 1997 further highlighted the interconnectedness of global economies and the speed at which a financial crisis can spread. Rapid currency devaluations and capital flight destabilized economies across Asia, leading to severe economic hardship. The crisis underscored the importance of financial resilience and adaptability in both national and international contexts.

The Global Financial Crisis of 2008, triggered by the collapse of the housing market in the United States, had far-reaching implications for the global economy. Financial institutions that were previously considered too big to fail required unprecedented government bailouts. The crisis led to significant regulatory reforms and changes in financial practices, demonstrating the critical role of adaptability in managing financial systems.

Understanding Adaptability: Definition and Key Elements

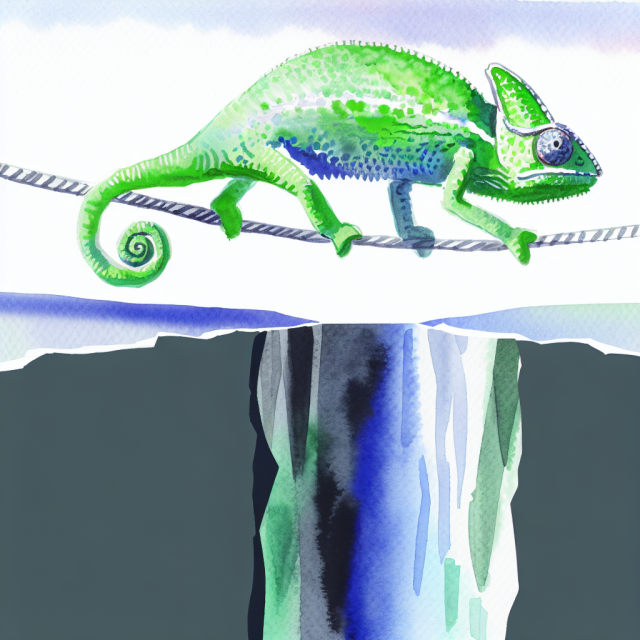

Adaptability refers to the ability to adjust to new conditions, environments, or challenges. In the context of financial crises, it involves the capacity to respond effectively to economic disruptions, manage risks, and capitalize on emerging opportunities. Key elements of adaptability include flexibility, resilience, resourcefulness, and proactive planning.

Flexibility involves the willingness to change strategies, processes, and behaviors in response to evolving circumstances. This can mean altering investment portfolios, diversifying income sources, or modifying business operations to suit new market realities. Flexibility ensures that individuals and organizations can quickly pivot and reduce exposure to financial risks.

Resilience is the ability to withstand and recover from setbacks. This is achieved through maintaining strong financial health, such as having adequate savings, managing debt wisely, and having access to emergency funds. Resilient entities are better positioned to absorb shocks and sustain operations during economic downturns.

Resourcefulness involves finding innovative solutions and leveraging available resources to navigate challenges. This can include optimizing existing assets, seeking alternative revenue streams, or utilizing technology to improve efficiency. Resourcefulness enables individuals and businesses to adapt creatively and maintain stability.

Proactive planning is essential for adaptability. This involves anticipating potential risks and preparing accordingly. Creating contingency plans, conducting risk assessments, and staying informed about economic trends are all part of proactive planning. It ensures that when a crisis arises, there are structured responses in place to mitigate its impact.

The Role of Adaptability in Mitigating Financial Stress

Adaptability plays a crucial role in mitigating financial stress during crises by enabling individuals and organizations to navigate uncertainties and minimize losses. One of the primary ways it does this is by fostering a proactive rather than reactive approach to financial management. Proactive measures such as building emergency funds, diversifying investments, and continuously updating financial plans can significantly reduce stress when a crisis hits.

Furthermore, adaptability allows for the identification and exploitation of new opportunities that may arise during a crisis. For example, businesses might pivot to new markets, develop new products, or adopt different business models to stay afloat. Such flexibility can turn potential losses into gains, helping to not only mitigate financial stress but also create pathways for growth.

Adaptable strategies also include maintaining open communication channels within organizations and with stakeholders. Clear and transparent communication helps to manage expectations and build trust. During times of financial uncertainty, keeping employees, customers, and investors informed can alleviate panic and stabilize business operations.

Case Studies: Businesses that Thrived Through Adaptability

Several businesses have successfully navigated financial crises by being adaptable. One notable example is Amazon, which thrived during the 2008 financial crisis. While many retailers suffered, Amazon adapted by enhancing its e-commerce platform, expanding product offerings, and leveraging advanced technologies such as cloud computing. Its adaptability allowed it not only to survive but also to significantly grow its market share.

Another example is Netflix, which transitioned from a DVD rental service to a streaming platform during the economic downturn. This strategic pivot allowed the company to tap into the growing demand for digital entertainment. By embracing new technologies and shifting its business model, Netflix emerged stronger from the financial crisis.

Procter & Gamble (P&G) also demonstrated adaptability during economic uncertainties by focusing on product innovation and market expansion. During the Global Financial Crisis, P&G introduced value brands to cater to cost-conscious consumers, while also investing in emerging markets. This dual strategy of innovation and diversification helped P&G to maintain strong financial performance during tough economic times.

Table: Examples of Businesses Adapting During Financial Crises

| Company | Crisis | Adaptation Strategy | Outcome |

|---|---|---|---|

| Amazon | 2008 Financial Crisis | Enhanced e-commerce, expanded offerings | Significant market growth |

| Netflix | 2008 Financial Crisis | Transition to streaming platform | Dominated digital entertainment |

| Procter & Gamble | 2008 Financial Crisis | Product innovation, market expansion | Maintained strong performance |

Strategies for Developing Adaptable Financial Plans

Developing adaptable financial plans involves several strategies designed to enhance flexibility and resilience. One effective approach is to incorporate scenario planning, where multiple potential future scenarios are mapped out and corresponding financial plans are developed. This prepares individuals and businesses for a range of possible outcomes, enabling them to respond quickly and effectively.

Another strategy is to diversify investments and income sources. Diversification spreads risk across different assets or revenue streams, reducing exposure to any single risk factor. This can involve investing in a mix of stocks, bonds, real estate, and alternative investments, or generating income through different business activities or side jobs.

Maintaining liquidity is also crucial for adaptability. Having readily accessible funds allows for quick responses to emergencies or opportunities. This can involve keeping cash reserves, maintaining lines of credit, or investing in highly liquid assets.

Regularly reviewing and updating financial plans is essential to ensure they remain relevant in changing economic conditions. This might involve adjusting investment portfolios, revising budgets, and re-evaluating financial goals. Continuous monitoring and flexibility in execution are key to adaptable financial planning.

The Psychological Benefits of Being Adaptable

Being adaptable not only helps in managing finances but also offers significant psychological benefits. One of the most notable advantages is a reduction in stress. Knowing that you have the capacity to adjust and respond to unforeseen circumstances can provide peace of mind, alleviating anxiety and uncertainty about the future.

Adaptability fosters a growth mindset, which is the belief that skills and intelligence can be developed through effort and learning. This mindset encourages individuals to view challenges as opportunities for growth rather than obstacles. By embracing change and viewing it positively, individuals can build resilience and improve their overall mental well-being.

Additionally, adaptability enhances problem-solving skills. The ability to think creatively and find effective solutions to unexpected problems boosts confidence and self-efficacy. Over time, this can lead to improved psychological resilience, allowing individuals to better handle stress and adversity in various aspects of their lives.

Technological Advances: Tools to Enhance Financial Adaptability

Technology has provided numerous tools to enhance financial adaptability. One of the most prominent advancements is the use of artificial intelligence (AI) and machine learning in financial planning and management. AI-driven tools can analyze vast amounts of data, identify trends, and provide insights that help individuals and businesses make informed decisions.

Financial management apps and software offer another layer of adaptability by allowing users to track income and expenses, set budgets, and manage investments from their smartphones or computers. These tools provide real-time updates and analysis, facilitating quick and informed financial decisions.

Blockchain technology and cryptocurrencies have also introduced new ways to enhance financial adaptability. They offer decentralized, secure, and efficient methods of conducting transactions, providing alternative investment options and means of financial management.

Government Policies and Support Systems

Government policies and support systems play a vital role in enhancing financial adaptability during crises. One significant aspect is the provision of fiscal stimulus packages, which inject liquidity into the economy to stabilize financial markets and support businesses and individuals. These measures can include direct financial aid, tax relief, and loan guarantees.

Regulatory reforms aimed at improving financial system stability are also crucial. These can include stricter capital requirements for banks, improved oversight of financial institutions, and enhanced transparency in financial transactions. Such measures help to build a more resilient financial system that can better withstand shocks.

Unemployment benefits and social safety nets provided by governments can alleviate financial stress for individuals who lose their jobs during economic downturns. These support systems ensure that basic needs are met, giving individuals the breathing room to adjust and find new employment opportunities.

Personal Finance: Managing Adaptability on an Individual Level

Managing adaptability on an individual level involves several key practices. Building an emergency fund is one of the most important steps. An emergency fund provides a financial cushion that can cover unforeseen expenses or loss of income, offering stability and peace of mind during crises.

Diversifying income sources is another practical approach. This can involve taking on freelance work, investing in rental properties, or developing passive income streams. Diversification reduces reliance on a single income source and spreads financial risk.

Financial education is essential for personal adaptability. Understanding basic financial principles, staying informed about economic trends, and continuously learning about new financial tools and strategies empower individuals to make informed decisions and navigate financial challenges effectively.

Future Outlook: Preparing for Potential Financial Crises

Preparing for future financial crises involves a combination of proactive planning, continuous learning, and leveraging technological advancements. One important aspect is staying informed about global economic trends and potential risk factors. This knowledge allows for early identification of emerging issues and timely adjustments to financial plans.

Continuous education and skill development are also crucial. The economic landscape is constantly evolving, and staying adaptable requires up-to-date knowledge and skills. This can involve taking courses, attending workshops, and reading relevant literature on financial management and economic trends.

Utilizing advanced technological tools for financial planning and management can enhance preparedness. AI-driven financial advisory services, blockchain-based financial solutions, and other fintech innovations provide sophisticated means of managing finances and mitigating risks.

Conclusion: Embracing Adaptability as a Long-term Strategy

Adaptability is not just a response to crises but a long-term strategy for financial resilience and growth. By fostering flexibility, resilience, resourcefulness, and proactive planning, individuals and organizations can navigate uncertainties and seize opportunities. The psychological benefits of reduced stress and enhanced problem-solving skills further underscore the importance of adaptability.

While financial crises are inevitable, the ability to adapt can transform challenges into growth opportunities. Historical and contemporary examples demonstrate that those who embrace adaptability are better positioned to thrive during economic downturns. Developing adaptable financial plans, leveraging technology, and utilizing support systems are practical steps to enhance adaptability.

Embracing adaptability as an ongoing strategy ensures preparedness for future financial crises. It equips individuals and organizations with the tools, mindset, and resilience needed to navigate an ever-changing economic landscape. Ultimately, adaptability is a key component of financial success and well-being.

Recap

- Financial crises are recurring phenomena with profound economic impacts.

- Adaptability involves flexibility, resilience, resourcefulness, and proactive planning.

- It plays a crucial role in mitigating financial stress and creating growth opportunities during crises.

- Historical examples like Amazon and Netflix illustrate the power of adaptability.

- Strategies for developing adaptable financial plans include scenario planning, diversification, and maintaining liquidity.

- Psychological benefits of adaptability include reduced stress and enhanced problem-solving skills.

- Technological tools like AI, financial management apps, and blockchain enhance financial adaptability.

- Government policies and support systems provide crucial assistance during financial crises.

- Personal finance strategies for adaptability include building emergency funds, diversifying income, and financial education.

- Preparing for future crises involves proactive planning, continuous learning, and leveraging technology.

FAQ

1. What is financial adaptability?

Financial adaptability refers to the ability to adjust and respond effectively to changing economic conditions and financial challenges.

2. Why is adaptability important during financial crises?

Adaptability helps to mitigate financial stress, identify new opportunities, and maintain stability during economic downturns.

3. How can businesses develop adaptable financial plans?

Businesses can develop adaptable financial plans through scenario planning, diversification, maintaining liquidity, and continuous financial review and updates.

4. What are some examples of businesses that thrived through adaptability?

Amazon, Netflix, and Procter & Gamble are examples of businesses that successfully navigated financial crises through strategic adaptations.

5. What psychological benefits does adaptability offer?

Adaptability reduces stress, fosters a growth mindset, and enhances problem-solving skills, improving overall mental well-being.

6. What technological tools can enhance financial adaptability?

AI-driven financial planning tools, financial management apps, and blockchain technology are some tools that enhance financial adaptability.

7. How do government policies support financial adaptability?

Government policies provide fiscal stimulus, regulatory reforms, and social safety nets that help stabilize financial markets and support individuals and businesses during crises.

8. How can individuals manage financial adaptability?

Individuals can manage financial adaptability by building emergency funds, diversifying income sources, and continuous financial education.

References

- Bernanke, B. (2013). “The Federal Reserve and the Financial Crisis.” Princeton University Press.

- Shiller, R. J. (2015). “Irrational Exuberance.” Princeton University Press.

- Taleb, N. N. (2010). “The Black Swan: The Impact of the Highly Improbable.” Random House.