## How to Identify and Avoid Financial Traps: A Comprehensive Guide

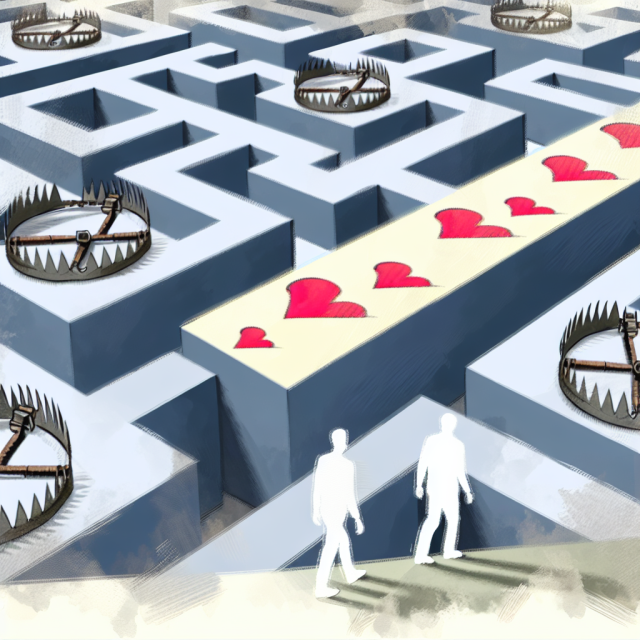

Financial stability is a goal that many strive to achieve, but the journey is often riddled with challenges. One significant hurdle is the various financial traps that can derail even the best-laid plans. Understanding these traps and knowing how to avoid them is essential for anyone looking to secure their financial future. In this comprehensive guide, we will delve into the intricacies of financial traps, examining what they are, why they occur, and how to steer clear of them.

The complexity of modern financial systems can make it easy to fall into these traps. From high-risk investments to debt pitfalls, the landscape is fraught with hazards that can erode your wealth and peace of mind. This guide aims to arm you with the knowledge necessary to navigate these challenges effectively.

We will explore common financial traps such as high-interest loans, credit card misuse, and fraudulent schemes. By understanding the psychology behind these traps, you will be better equipped to identify and avoid them. Additionally, we will offer practical tips for smart financial planning, boosting your financial literacy, and seeking professional advice.

Ultimately, the goal is to help you build a secure financial future, free from the pitfalls that have ensnared many before you. By the end of this guide, you will have a comprehensive understanding of how to protect your finances and make informed decisions that enhance your financial well-being.

Understanding Financial Traps: An Overview

Financial traps are situations or schemes designed to ensnare individuals, causing significant financial loss or hardship. These traps can be subtle or glaringly obvious, but they all operate on common principles aimed at exploiting human behavior and financial vulnerabilities.

One key feature of financial traps is their ability to appear beneficial or harmless at first glance. For instance, an investment opportunity promising high returns might seem like a great deal, but upon closer scrutiny, it may reveal hidden risks or unsustainable conditions. The allure of quick, easy money blinds individuals to the potential pitfalls, making it essential to perform due diligence before committing any resources.

Financial traps are not limited to investments; they also encompass debt-related issues, overspending, and even seemingly innocuous financial products. For example, payday loans might provide immediate relief but come with exorbitant interest rates that can lead to a cycle of debt. Credit card misuse can also result in overwhelming debt due to high-interest rates and fees.

Understanding the mechanics of these traps is the first step in avoiding them. Recognizing the signs and staying informed about potential risks can help individuals make better financial decisions. Education and vigilance are crucial in safeguarding one’s financial health.

Common Financial Traps to Watch Out For

There are several financial traps that individuals commonly fall into, each with its unique set of challenges and consequences. Here, we will discuss some of the most prevalent ones to be aware of.

High-Interest Loans

High-interest loans, such as payday loans and certain types of personal loans, can provide quick access to cash but at a significant cost. The high-interest rates associated with these loans can quickly accumulate, making it difficult for borrowers to repay the principal amount. This can lead to a cycle of debt that is hard to escape.

Investment Scams

Investment scams are schemes designed to defraud investors by promising high returns with little or no risk. Common examples include Ponzi schemes and pyramid schemes. These scams often rely on convincing potential investors that they can make significant profits quickly, leading to substantial financial losses when the scam collapses.

Credit Card Debt

Credit card debt is another common financial trap. While credit cards can be a convenient way to manage expenses, they can also lead to overwhelming debt if not used responsibly. High-interest rates and fees can quickly add up, making it difficult to pay off the balance and leading to a cycle of debt.

Table: Comparison of Common Financial Traps

| Financial Trap | Characteristics | Risks |

|---|---|---|

| High-Interest Loans | Quick cash, high-interest rates | Debt cycle, financial strain |

| Investment Scams | Promises of high returns, low risk | Significant financial loss |

| Credit Card Debt | Convenience, high fees | Overwhelming debt, high costs |

The Psychology Behind Financial Traps

Understanding the psychology behind financial traps is crucial in recognizing and avoiding them. Several psychological factors contribute to why individuals fall into these traps.

The Illusion of Quick Profits

One of the primary psychological factors is the allure of quick profits. Many financial traps promise immediate financial gains, which can be incredibly tempting. The idea of making money quickly with minimal effort can cloud judgment, leading individuals to overlook potential risks and warnings.

Overconfidence Bias

Overconfidence bias is another psychological factor that plays a significant role. Many individuals believe they are savvy enough to navigate financial challenges on their own. This overconfidence can lead to underestimating the risks and overestimating their ability to manage financial decisions, making them susceptible to traps.

Fear of Missing Out (FOMO)

The fear of missing out, or FOMO, is a powerful psychological driver. When individuals see others seemingly succeeding with a particular investment or financial product, they may feel pressured to join in, fearing they will miss an opportunity. This can lead to hasty decisions without proper research or consideration of the risks.

Loss Aversion

Loss aversion refers to the tendency to prefer avoiding losses over acquiring equivalent gains. This can lead individuals to hold onto failing investments or engage in risky financial behavior to avoid realizing a loss, further entrenching them in financial traps.

How to Identify High-Risk Investments

High-risk investments can promise substantial returns but often come with significant dangers. Identifying these high-risk investments is essential in protecting your financial health.

Promises of High Returns with Low Risk

One of the most common red flags for high-risk investments is the promise of high returns with low or no risk. In the financial world, high returns usually come with high risks. Be wary of any investment opportunity that claims otherwise.

Lack of Transparency

Another sign of a high-risk investment is a lack of transparency. If the details of the investment are not clear, or if it’s difficult to obtain information about how the investment works, it’s a major red flag. Legitimate investments should be transparent and provide all necessary information upfront.

Pressure Tactics

High-pressure sales tactics are often used to push high-risk investments. If an investment opportunity comes with a sense of urgency or pressure to act immediately, it’s a red flag. Take your time to research and consider the investment carefully, without succumbing to pressure.

Table: Signs of High-Risk Investments

| Sign | Description |

|---|---|

| High Returns with Low Risk | Promises of significant gains without corresponding risk |

| Lack of Transparency | Difficulty in obtaining clear information |

| Pressure Tactics | Urgency or pressure to act quickly |

Recognizing and Avoiding Debt Traps

Debt traps are financial pitfalls that can lead to a cycle of debt and financial stress. Recognizing and avoiding these traps is crucial for maintaining financial health.

High-Interest Loans and Payday Loans

High-interest loans, such as payday loans, are a common source of debt traps. These loans may seem like a solution during financial crises, but their exorbitant interest rates can lead to unmanageable debt. It’s crucial to explore alternatives before resorting to high-interest loans.

Minimum Payment Trap with Credit Cards

The minimum payment trap is another form of debt trap. Paying only the minimum amount due on credit card bills can lead to substantial interest charges over time. It’s essential to pay more than the minimum whenever possible to avoid accumulating debt.

Refinancing and Debt Consolidation Pitfalls

While refinancing and debt consolidation can help manage debt, they can also become traps if not handled carefully. These options can lead to extending the debt repayment period or accumulating more debt if additional credit is taken. Always evaluate the long-term implications before choosing these options.

The Dangers of Credit Card Misuse

Credit cards can be useful financial tools, but misuse can lead to significant financial problems. Understanding the dangers of credit card misuse is vital in avoiding such issues.

High-Interest Rates and Fees

Credit cards often come with high-interest rates and fees. If balances are not paid in full each month, interest charges can accumulate, leading to significant debt. It’s essential to be mindful of these costs and strive to pay off balances regularly.

Overuse and Overspending

Credit card misuse often involves overuse and overspending. Relying too heavily on credit cards for everyday expenses can lead to overspending and financial strain. It’s important to use credit cards responsibly and keep spending within manageable limits.

Impact on Credit Score

Misusing credit cards can negatively impact your credit score. Late payments, high balances, and maxing out credit limits can all damage your credit score, making it difficult to obtain loans and favorable terms in the future. Maintaining responsible credit card habits is key to protecting your credit score.

How to Spot Fraudulent Schemes

Fraudulent schemes are designed to deceive individuals and steal their money. Being able to spot these schemes is crucial in protecting your finances.

Too Good to Be True Offers

One of the most common signs of a fraudulent scheme is an offer that seems too good to be true. Promises of guaranteed returns, no-risk investments, and other unrealistic claims should be approached with skepticism.

Requests for Personal Information

Fraudulent schemes often involve requests for personal information, such as Social Security numbers, bank account details, or credit card information. Be cautious of any unsolicited request for sensitive information and verify the legitimacy of the source before providing any details.

Unsolicited Offers and Communication

Unsolicited offers and communication, particularly those that are aggressive or pushy, can be a sign of a fraudulent scheme. Be wary of any unsolicited contact that pressures you to invest or provide personal information.

Tips for Smart Financial Planning

Smart financial planning is crucial for avoiding financial traps and securing your future. Here are some tips to help you manage your finances effectively.

Create a Budget

Creating a budget is the foundation of smart financial planning. A budget helps you track your income and expenses, ensuring that you live within your means and can save for future goals.

Build an Emergency Fund

Building an emergency fund is essential for financial security. An emergency fund can help you cover unexpected expenses without resorting to high-interest loans or credit cards.

Diversify Your Investments

Diversifying your investments helps spread risk and increase the likelihood of returns. Avoid putting all your money into a single investment. Instead, spread your investments across different asset classes and sectors.

Table: Financial Planning Tips

| Tip | Description |

|---|---|

| Create a Budget | Track income and expenses to live within your means |

| Build an Emergency Fund | Save for unexpected expenses |

| Diversify Investments | Spread risk across different investments |

Educating Yourself on Financial Literacy

Financial literacy is the knowledge and skills needed to make informed and effective financial decisions. Investing in your financial education is crucial for avoiding financial traps and achieving financial stability.

Understand Basic Financial Concepts

Understanding basic financial concepts, such as interest rates, inflation, and compound interest, is essential. These concepts form the foundation of financial literacy and help you make informed decisions.

Learn About Financial Products

Familiarize yourself with different financial products, such as savings accounts, investment accounts, loans, and credit cards. Knowing how these products work and their pros and cons will help you choose the best options for your needs.

Seek Out Educational Resources

There are many educational resources available to help you improve your financial literacy. Books, online courses, seminars, and financial blogs can provide valuable information and insights. Make use of these resources to continually enhance your financial knowledge.

Seeking Professional Financial Advice

Professional financial advice can be invaluable in navigating financial challenges and making informed decisions. Here are some tips for seeking professional financial advice.

Choose a Qualified Financial Advisor

When seeking professional financial advice, choose a qualified financial advisor with the necessary certifications and experience. A reputable advisor can provide personalized guidance based on your financial situation and goals.

Ask Questions

Don’t hesitate to ask questions when working with a financial advisor. It’s important to fully understand the advice and recommendations being given. Asking questions helps ensure that you make informed decisions.

Regularly Review Your Financial Plan

Regularly reviewing your financial plan with your advisor ensures that it remains aligned with your goals and circumstances. Periodic reviews help you stay on track and make necessary adjustments as needed.

Building a Secure Financial Future

Building a secure financial future requires careful planning and mindful decision-making. Here are some strategies to help you achieve financial security.

Set Financial Goals

Setting clear financial goals gives you direction and motivation. Whether it’s saving for retirement, buying a home, or funding education, having specific goals helps you stay focused and committed.

Practice Financial Discipline

Financial discipline is crucial for achieving financial security. This involves sticking to your budget, avoiding unnecessary debt, and making mindful spending decisions. Practicing financial discipline helps you build wealth over time.

Plan for the Long Term

Long-term planning is essential for financial security. This includes retirement planning, estate planning, and considering future financial needs. A long-term perspective helps ensure that you are prepared for various life stages and financial challenges.

Recap

Let’s summarize the key points covered in this guide on identifying and avoiding financial traps:

- Financial Traps Overview: Understanding the types and mechanics of financial traps is essential for avoiding them.

- Common Financial Traps: Awareness of high-interest loans, investment scams, and credit card debt can help you steer clear of these pitfalls.

- Psychology Behind Financial Traps: Recognizing psychological factors such as the allure of quick profits and loss aversion is crucial in preventing financial missteps.

- Identifying High-Risk Investments: Be cautious of investments promising high returns with low risk, lack of transparency, and high-pressure tactics.

- Recognizing Debt Traps: Stay vigilant about high-interest loans, minimum payment traps, and the long-term implications of refinancing and debt consolidation.

- Credit Card Misuse: Maintain responsible habits to avoid high-interest debt and negative impacts on your credit score.

- Spotting Fraudulent Schemes: Be wary of too-good-to-be-true offers, unsolicited requests for personal information, and aggressive communication.

- Smart Financial Planning: Create a budget, build an emergency fund, and diversify investments for effective money management.

- Financial Literacy: Continually educate yourself on financial concepts and products to make informed financial decisions.

- Professional Financial Advice: Seek qualified advice, ask questions, and regularly review your financial plan.

- Building a Secure Future: Set clear financial goals, practice discipline, and plan long-term for financial security.

Conclusion

Avoiding financial traps requires a combination of knowledge, vigilance, and disciplined decision-making. By understanding the common financial traps and the psychology behind them, you can take proactive steps to protect your finances.

Smart financial planning and continuous education are crucial components of financial security. Creating a budget, building an emergency fund, and diversifying investments are practical steps that can help you manage your money effectively.

Seeking professional financial advice and being mindful of long-term goals further support your journey towards a secure financial future. By incorporating these strategies, you can achieve financial stability and avoid the pitfalls that have ensnared many.

FAQ

Q1: What are financial traps?

A1: Financial traps are situations or schemes designed to cause financial loss or hardship, often by exploiting human behavior and financial vulnerabilities.

Q2: How can I avoid high-interest loans?

A2: Explore alternatives such as personal savings, credit unions, or asking for help from family and friends before resorting to high-interest loans.

Q3: What should I do if I suspect an investment scam?

A3: Thoroughly research the investment, consult with a financial advisor, and report any suspicious activity to authorities.

Q4: How can I avoid credit card debt?

A4: Use credit cards responsibly by paying off balances in full each month, avoiding unnecessary purchases, and keeping spending within limits.

Q5: What are some signs of a fraudulent scheme?

A5: Be cautious of offers that seem too good to be true, requests for personal information, and unsolicited, aggressive communication.

Q6: Why is financial literacy important?

A6: Financial literacy helps you make informed and effective financial decisions, avoiding traps and achieving financial stability.

Q7: How often should I review my financial plan?

A7: Regularly review your financial plan, at least annually, or whenever there are significant changes in your financial situation.

Q8: What are some tips for smart financial planning?

A8: Create a budget, build an emergency fund, diversify investments, and set clear financial goals.

References

- Federal Trade Commission. “How to Avoid Financial Scams.” FTC.gov

- National Endowment for Financial Education. “The Importance of Financial Literacy.” NEFE.org

- Consumer Financial Protection Bureau. “Managing Credit Cards.” ConsumerFinance.gov