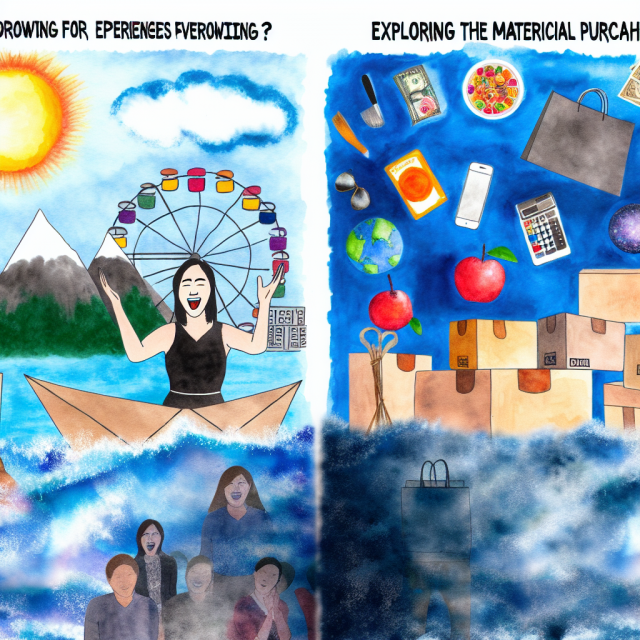

Introduction to Experiential vs. Material Spending

In the landscape of personal finance, the debate between spending on experiences versus material goods has gained significant attention. The core question revolves around where individuals derive more happiness – from the memories of experiences or the tangible satisfaction of material items. This contemplation becomes even more pronounced when borrowing is involved, as it can dictate the way one chooses to allocate financial resources between these two categories.

Recent studies suggest that experiences such as vacations, concerts, or fine dining tend to create longer-lasting happiness compared to material purchases like electronics or jewelry. The reasoning is simple yet complex: experiences enrich individuals’ lives emotionally and socially, often creating lifelong memories. On the other hand, material items offer immediate gratification but may not provide sustained satisfaction over time.

Financially, the implications of choosing experiences over material goods and vice versa are profound. Borrowing for an experience, for instance, might justify the immediate joy and memories but raises questions about financial prudence. Is going into debt for experiences justifiable, or is it another spur-of-the-moment decision with long-term repercussions? On the flip side, material purchases may offer longer-term utility but might not match the emotional fulfillment experiences provide.

This article delves into the emotional and financial impacts of borrowing for experiences in contrast to material purchases, providing insights from psychology, consumer trends, and real-world case studies. We aim to explore not only personal preferences but also broader societal trends and expert opinions to guide readers in making informed financial decisions that align with their goals and values.

The Psychology of Spending on Experiences vs. Material Goods

The psychological underpinnings of spending choices provide a fertile ground for understanding why experiences often lead to more sustained happiness than material goods. Research in psychology suggests that experiential purchases are more likely to foster feelings of fulfillment and joy, as they generally lead to rich storytelling and shared moments with others.

One reason for the heightened emotional impact of experiences is their ability to be intertwined with one’s identity. When people reflect on their lives, they think of the journey—the places they’ve visited, the adventures they’ve embarked upon, and the people they’ve met. These form an integral part of one’s narrative, giving depth to personal history. In contrast, material goods, while valuable, tend not to form such profound parts of one’s identity and often become obsolete or less appreciated over time.

Moreover, experiences are less likely to be compared with others’ purchases, mitigating feelings of jealousy or inadequacy. If your friend buys a bigger car or a more luxurious item, it might prompt a sense of envy; however, this scenario is less likely with experiences. This distinction underscores why individuals who prioritize experiences often report higher levels of happiness – they focus on personal growth and connections rather than mere ownership.

How Borrowing for Experiences Affects Emotional Wellbeing

Borrowing for an experience, like a dream vacation or a once-in-a-lifetime concert, can have several emotional implications. While initially, the enthusiasm of the upcoming experience can foster excitement and anticipation, the shadow of debt may later cast a daunting cloud. This points to a critical balance between emotional gains and financial responsibility.

The presence of debt has a well-documented negative impact on mental health. Anxiety, stress, and even depression can stem from financial obligations that one is unable to meet comfortably. However, when managed wisely, borrowing for experiences can still offer enriching benefits. The anticipation of an experience provides pleasure long before the event occurs, contributing to overall life satisfaction.

Furthermore, the afterglow of an experience, the memories, and stories it creates, tend to last much longer than similar effects from material goods. Despite initial concerns about financial burdens, many individuals report memorable experiences as investments in happiness—associating them with personal growth, learning, and deeper social connections. The key is ensuring that such borrowing aligns with one’s broader financial strategy to avoid prolonged financial strain.

Analyzing Financial Impacts of Spending on Experiences

Financially, borrowing for experiences is a nuanced topic. A key consideration is how expenses align with one’s financial goals and resources. Borrowing for experiences can be wise if it fits within an individual’s financial plan without leading to excessive debt.

One major financial advantage of experiential spending is that it often involves one-time costs rather than continuous expenditure. For instance, a vacation typically incurs upfront booking and travel costs, whereas some material goods, like cars or electronics, may require ongoing expenses such as maintenance and upgrades, adding to the long-term financial burden.

To further illustrate the impact, consider the following comparison table:

| Aspect | Experiences | Material Goods |

|---|---|---|

| Initial Cost | Usually one-time | Often one-time |

| Long-term Costs | Rarely any | Maintenance, upgrades |

| Depreciation | None | Can depreciate rapidly |

| Emotional Returns | Potentially long-lasting | Short-term gratification |

However, it’s crucial to recognize the trade-offs. Borrowing incurs interest, which means experiences can ultimately cost more than their initial price. Consequently, potential borrowers should assess the terms of any loans or credit agreements to ensure they do not lead to unsustainable debt levels.

Long-term Satisfaction: Experiences vs. Material Goods

Long-term satisfaction derived from spending is a critical factor influencing consumer preferences. Experiences, by their nature, usually leave a lasting impact on one’s emotional state and life satisfaction. The sense of joy, excitement, and learning that accompanies new experiences can satisfy personal aspirations for growth and improvement.

Material goods, while practical and often necessary, typically provide diminishing returns on happiness. The phenomenon of the “hedonic treadmill” suggests that people quickly return to a baseline level of happiness after acquiring new items, leading to a cycle of continual purchasing without significant, long-lasting emotional satisfaction.

Interestingly, studies show that people often mispredict future happiness from purchases, believing that material items will make them happier for a more extended period than they do. Conversely, they may underestimate the lasting joy experiences bring. This misjudgment highlights the importance of intentionality in spending choices to ensure they align with personal values and satisfaction goals.

Consumer Behavior: Trends in Spending on Experiences

Recent consumer behavior trends reveal a notable shift toward experiential spending. Millennials and Gen Z, in particular, often prioritize experiences over material goods, driven by a desire for personal growth, cultural enrichment, and social connection. This trend is evident in the rise of industries such as travel, dining, and entertainment.

Several factors contribute to this shift:

- Social Media Influence: Platforms like Instagram foster a culture where people seek validation and community by sharing experiences rather than possessions.

- Sustainability Consciousness: Awareness of environmental impact encourages minimalism and conscientious consumption, which experiences often align with more closely than material goods.

- Digital Detox Movement: As individuals seek breaks from digital saturation, they opt for experiences that offer a sense of presence and mindfulness.

These trends indicate a broader cultural movement toward valuing life experiences over tangible goods. Understanding these preferences can help businesses tailor offerings and marketing strategies to meet evolving consumer demands.

Case Studies: Borrowing for Vacation vs. Buying a New Gadget

To better understand the implications of borrowing for experiences versus material goods, let’s consider two case studies:

Case 1: Borrowing for a European Vacation

Jessica, a recent college graduate, decided to take a two-week backpacking trip across Europe. Unable to cover all expenses upfront, she borrowed $3,000 through a personal loan. For Jessica, this trip was about cultural immersion and self-discovery. Despite accruing interest on her loan, she viewed the experience as invaluable—yielding memories and stories she cherishes. Over time, she didn’t regret the financial decision, as the personal growth and happiness outweighed her debt concerns.

Case 2: Buying a New Smarphone

John, a tech enthusiast, opted to purchase the latest smartphone using a credit card. The $1,200 gadget came with monthly payments stretching over two years. Initially, the phone offered excitement and utility, but newer models quickly emerged, diminishing his satisfaction. The lingering payments and the phone’s rapid obsolescence left John reflecting on the imprudence of his choice. He realized his dopamine-driven purchase led to short-term excitement at the expense of long-term financial strain.

These cases highlight the nuanced considerations involved in choosing between experiences and material goods when borrowing funds.

The Impact of Experiences on One’s Social Life and Relationships

The impact of experiences on social life and relationships can be profound. Shared experiences often serve as social glue, bringing people together and fostering a sense of community and belonging. They provide common ground for conversation, bonding, and collective memory-making, which are less likely to occur through shared material possessions.

Experiences encourage participation, interaction, and shared enjoyment, stimulating positive social behaviors. Attending events, traveling with friends, or joining group activities can foster strong relationships, provide deeper levels of connection, and contribute to a support network crucial for emotional wellbeing.

Moreover, experiences often lead to the formation of social capital—bonds, networks, and resources one can call upon in times of need. This reliance on shared histories and memories enhances not only individual happiness but collective resilience and strength in relationships, underlining the social value of experiential spending.

Why People Choose Experiential Purchases Over Material Ones

There is a growing preference for experiential over material purchases, and several key reasons underpin this trend:

-

Personal Growth: Experiences offer opportunities for learning, exploration, and self-improvement, aligning with many individuals’ pursuits for personal development.

-

Memorability: Experiences tend to leave lasting impressions and stories that contribute to personal identity and narrative, whereas material goods often become mundane.

-

Social Connection: Experiential purchases frequently involve or are shared with others, enhancing social bonds and creating shared memories.

-

Sustainability: Increasing awareness of environmental sustainability encourages choices that have less ecological footprint, which many experiences do compared to material goods.

-

Cultural Values: As societal values shift toward minimalism and mindful living, experiences become more aligned with broader cultural currents that emphasize fulfillment over accumulation.

Understanding these motivations can help explain why many people now choose experiences over material possessions, highlighting a fundamental shift in consumer priorities.

Expert Opinions: Financial Advisors on Spending Habits

Financial advisors often play a critical role in helping individuals balance their spending habits, offering insights that blend emotional fulfillment with prudent fiscal management. Most experts agree that while experiences can provide meaningful satisfaction, they should not detract from financial security.

Key considerations from financial advisors include:

- Budgeting: Allocate a specific portion of income for experiential spending without compromising savings or essential expenses.

- Debt Management: If borrowing for an experience, ensure that repayment terms are manageable within the broader financial picture to avoid unnecessary financial strain.

- Prioritization: Align spending with personal values and long-term goals, ensuring that both experiential and material purchases serve a meaningful purpose.

Financial advisors advocate for a balanced approach that accounts for both short-term happiness and long-term financial health, reflecting a comprehensive strategy for sustainable living.

Conclusion: Evaluating Personal Goals and Financial Health

The debate over borrowing for experiences versus material purchases is both complex and deeply personal. Ultimately, the decision largely hinges on one’s values, goals, and personal financial situation. By weighing the emotional benefits against financial implications, individuals can make informed decisions that align with their broader life ambitions.

Experiential purchases often offer rich emotional rewards that material goods cannot match. Yet, the financial trade-off should not be overlooked. Borrowing to fund experiences can be part of a healthy financial strategy if managed wisely, without compromising other financial obligations.

For each individual, identifying personal priorities and understanding the motivations behind spending—whether for experiences or material goods—is critical. By engaging in mindful consumer behavior and seeking expert advice when necessary, individuals can navigate the complexities of spending choices to maximize both emotional and financial wellbeing.

Recap

- Introduction to Experiential vs. Material Spending: Outlines the core debate and highlights the focus on borrowing impacts.

- Psychology and Emotional Impact: Discusses why experiences often lead to sustained happiness compared to material goods.

- Financial Impact: Highlights one-time costs of experiences versus ongoing material expenses and the financial challenges of borrowing.

- Long-term Satisfaction: Experiences create lasting impressions and personal growth, unlike many material goods.

- Consumer Trends and Social Impact: Experiential spending reflects changing consumer behavior and enhances social connections.

- Expert Advice: Emphasizes the importance of budgeting and strategic spending aligned with personal goals.

FAQ

- Is it better to borrow for experiences or material goods?

- Borrowing for experiences can be more rewarding emotionally but must be aligned with personal financial capabilities.

- Do experiences offer more long-term satisfaction than material purchases?

- Generally, yes. Experiences are associated with personal growth and lasting memories, providing prolonged satisfaction.

- How do experiences impact social relationships?

- Shared experiences foster social connections and create common memories, enhancing relationship quality.

- Why are people spending more on experiences now?

- Cultural shifts toward minimalism, environmental awareness, and personal growth have driven this trend.

- What do financial advisors say about borrowing for experiences?

- They recommend careful budgeting and ensuring that experiences do not lead to unsustainable debt.

- Are experiences financially beneficial in the long run?

- They can be, as they usually involve one-time costs without ongoing financial commitments.

- Do material goods ever provide more happiness than experiences?

- Material goods can provide temporary satisfaction but often do not match the emotional depth of experiences.

- Can borrowing for experiences affect mental health?

- While initial excitement boosts emotional wellbeing, potential debt stress can have negative mental health impacts.

References

- Van Boven, L., & Gilovich, T. (2003). “To Do or to Have? That Is the Question.” Journal of Personality and Social Psychology.

- Kumar, A., & Gilovich, T. (2014). “The psychological benefits of experiential purchases.” Journal of Experimental Social Psychology.

- Dunn, E. W., & Norton, M. I. (2013). “Happy Money: The Science of Happier Spending.” Simon & Schuster.